Financial Market:

The production and exchange of financial assets take place on the financial market. Shares, bonds, derivatives, commodities, currencies, and other financial assets are examples. Any country’s financial market is essential to how its economy distributes its limited resources. While some financial markets are very small and have little activity, others move trillions of securities every single day. By transferring money between savers and investors, it serves as a bridge between them. This means that the financial market provides buyers and sellers with a platform to trade assets at a price that is decided by market factors, such as supply and demand. In the rest of this article, we are going to present you with the Types of Financial Markets, their Functions, and the Importance of Financial Markets.

Definition of Financial Market:

There are several definitions invented in financial marketing which are not equally significant. Some of the necessary definitions are given below:

A financial market is a market in which people trade financial securities and derivatives at low transaction costs (Wikipedia).

A marketplace that provides an avenue for the sale and purchase of assets such as bonds, stocks, foreign exchange, and derivatives (Corporate Finance Institute – CFI).

Financial Markets include any place or system that provides buyers and sellers the means to trade financial instruments, including bonds, equities, various international currencies, and derivatives (Office of the Comptroller of the Currency – OCC).

From the above definitions, we can say that a financial market is a marketplace where bonds, equity, securities, and currencies are traded.

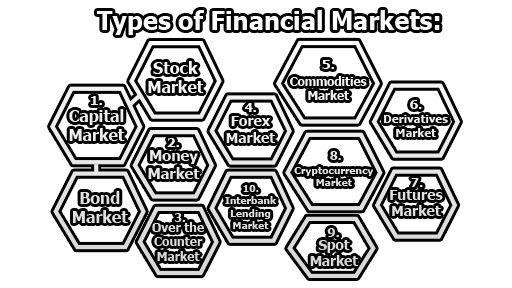

Types of Financial Markets:

There are several types of financial markets, which are as follows:

1. Capital Market: A capital market is a financial market in which long-term debt or equity-backed securities are bought and sold for periods longer than a year. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. The capital market consists of;

- Stock Market: provide financing through the issuance of shares or common stock, and enable the subsequent trading thereof.

- Bond Market: The bond market provides chances for corporations, states, municipalities, and federal governments to receive funding for a venture or investment. Investors purchase bonds from a company in a bond market, and the company returns the bonds’ principal balance within a predetermined time frame, plus interest.

2. Money Market: The money market is used by participants as a means for borrowing and lending in the short-term range from overnight to just under a year. Among the most common money market instruments are euro-dollar deposits, negotiable certificates of deposit (CDs), bankers’ acceptances, U.S. Treasury bills, commercial paper, municipal notes, federal funds, and repurchase agreements.

3. Over the Counter (OTC) Market: Market participants transact in securities directly between two parties without the use of a broker in this decentralized market, which has no physical locations and only conducts trading electronically. The OTC market dealing with companies are usually small companies that can be traded cheaply and have less regulation.

4. Forex Market: Investors can trade currencies on this financial market. This is the most liquid financial market in the entire globe. The forex market is made up of banks, commercial enterprises, central banks, asset management businesses, hedge funds, as well as small-scale currency dealers and investors.

5. Commodities Market: Natural resources or commodities like corn, oil, meat, and gold are bought and sold on the commodities market by merchants and investors. Such resources have their own market because of the unpredictable nature of their prices. In the futures market for commodities, the price of the goods that will be delivered at a specific time in the future has already been determined and sealed.

6. Derivatives Market: They trade in securities whose value is derived from the company’s main asset. The market price of the underlying security (controls the value of the corresponding derivative contract), which are securities traded on the derivatives market, such as individuals and firms can trade in futures, options, forward contracts, and swaps.

7. Futures Market: A futures market is an auction market where participants trade futures and commodities contracts for delivery on predetermined dates in the future. Futures are exchange-traded derivatives contracts that guarantee the delivery of a good or asset at a price established today, regardless of when it is delivered.

8. Cryptocurrency Market: Cryptocurrencies like Bitcoin and Ethereum, decentralized digital assets built on blockchain technology, have been introduced and have grown significantly over the past several years. Today, a variety of independent online cryptocurrency exchanges offer hundreds of cryptocurrency tokens for trading. These exchanges provide traders with access to digital wallets where they can exchange one cryptocurrency for another or for fiat money like dollars or euros.

9. Spot Market: A public financial market where commodities or financial instruments are traded for immediate delivery is called the spot market or cash market.

10. Interbank Lending Market: The interbank lending market is a market in which banks lend funds to one another for a specified term. Most interbank loans have a maturity of one week or less, and the majority of them have a day or more. These loans are provided at interbank rates (also called the overnight rate if the term of the loan is overnight).

Functions of Financial Markets:

The key functions of the financial markets are listed below;

- Savings are mobilized by exchanging funds in the most effective ways.

- It helps determine the price of securities through interactions with investors and consideration of market supply and demand.

- It provides assets that have been bartered with liquidity.

- Cost-effective and less time-consuming when it makes transactions.

- It makes available the potential buyer and seller easily, which supports them save their time and money in finding the potential buyer and seller.

Importance of Financial Markets:

Financial markets enable a wide range of activities, including the following:

- To provide a place where stakeholders like debtors and investors, regardless of their size, will be treated fairly.

- It provides access to capital for individuals, businesses, and governmental entities.

- It contributes to a lower unemployment rate by providing a variety of employment options.

- Minimizing risks by some strategies such as hedging or diversification.

- It provides a source of capital for businesses depending on short-term or long-term financing requirements for both commercial and public sectors.

It is apparent that the market where traders engage in the buying and selling of financial assets including shares, bonds, derivatives, commodities, currencies, etc. is known as the financial market. It is a system or corporation that makes it easier to exchange financial instruments and securities.

Library Lecturer at Nurul Amin Degree College