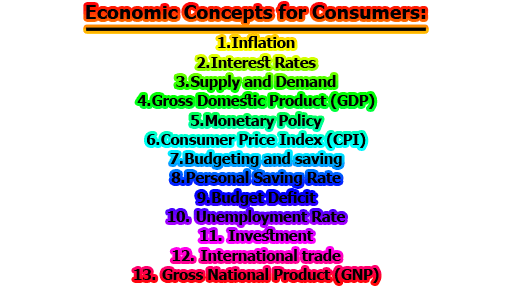

Economic Concepts for Consumers:

Economic concepts are fundamental ideas that help us understand how the economy works and how it affects our daily lives. As a consumer, it is important to have a good understanding of some key economic concepts in order to make informed decisions about your finances. Here are some significant economic concepts for consumers that you need to know:

- Inflation: Inflation refers to the sustained increase in the general price level of goods and services in an economy over a period of time. It affects the purchasing power of consumers, as their money can buy fewer goods and services when prices are rising.

- Interest Rates: Interest rates are the fees charged by lenders for borrowing money. They play a crucial role in consumer borrowing, as higher interest rates can make loans more expensive, which can reduce consumer spending and overall economic activity.

- Supply and Demand: Supply and demand is a fundamental concept in economics that describes the interaction between the availability of a product and the willingness of consumers to buy it. When demand for a product is high, prices tend to rise, while when demand is low, prices tend to fall.

- Gross Domestic Product (GDP): GDP is the total value of goods and services produced within a country’s borders over a certain period of time. It is a key indicator of a country’s economic health, as a growing GDP is generally seen as a sign of a strong economy, while a declining GDP can be a sign of economic trouble.

- Monetary Policy: Monetary policy refers to the actions taken by a central bank, such as the Federal Reserve in the United States, to control the money supply and interest rates. This can impact consumer spending and borrowing, as changes in monetary policy can affect the cost and availability of credit.

- Consumer Price Index (CPI): The Consumer Price Index is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It is often used as a measure of inflation.

- Budgeting and saving: Budgeting and saving are important skills for managing personal finances. Budgeting involves creating a plan for how to spend and save money, while saving involves setting aside money for future expenses. Understanding these concepts can help consumers make informed decisions about their spending and saving habits, which can have a significant impact on their financial well-being.

- Personal Saving Rate: The personal saving rate is the percentage of disposable income that is saved rather than spent. A high saving rate is generally seen as a positive sign, as it indicates that consumers are saving for the future, while a low saving rate can be a sign of overspending and financial vulnerability.

- Budget Deficit: A budget deficit occurs when a government spends more money than it takes in through tax revenue. This can impact consumer spending, as government borrowing can drive up interest rates and make it more expensive for consumers to borrow money.

- Unemployment Rate: The unemployment rate is the percentage of the labor force that is without work but actively seeking employment. High unemployment can impact consumer spending, as people without jobs are less likely to have money to spend.

- Investment: Investment refers to the act of putting money into a financial product or asset with the expectation of earning a return. Understanding investment can help consumers make informed decisions about how to grow their wealth over time and plan for their financial future.

- International trade: International trade refers to the exchange of goods and services between countries. Understanding international trade can help consumers make informed decisions about purchasing goods and services from different countries, and can also help them understand the impact of global economic conditions on their local economy.

- Gross National Product (GNP): Gross National Product is the total value of goods and services produced by a country’s residents, including those living abroad, over a certain period of time. It is a measure of a country’s economic output and can be used to compare the economic performance of different countries.

In conclusion, understanding the key economic concepts discussed above is crucial for consumers to effectively manage their finances and make informed decisions. These concepts help individuals understand how the economy works and how it impacts their daily lives. By understanding inflation, interest, GDP, supply and demand, the Consumer Price Index, saving and investing, and budgeting, consumers can make informed decisions about spending, saving, and investing their money. With this knowledge, consumers can achieve their financial goals, build wealth, and maintain financial stability over the long term.

Former Student at Rajshahi University