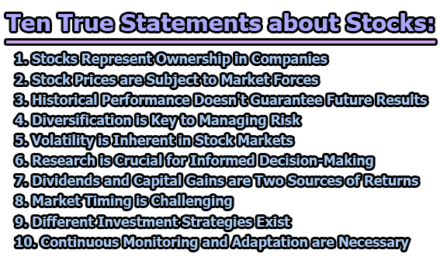

Investment is the act of allocating resources, such as money, time, or effort, with the expectation of generating a positive return in the future. This involves the purchase or acquisition of assets that are expected to appreciate in value over time or generate income, such as stocks, bonds, real estate, commodities, or business ventures. The goal of investment is to increase wealth or financial security over the long term by deploying resources in a way that generates a positive return while minimizing risk. Successful investing requires careful analysis of market trends, risk assessment, and diversification of assets to achieve a balanced portfolio that can withstand fluctuations in the economy and financial markets. In this article, we are going to know about the objectives of investment.

Definitions of Investment:

Here are some definitions of investment from different perspectives:

From a financial perspective, investment refers to the act of allocating resources, such as money or time, with the expectation of generating future benefits or returns. The goal of investment is to use existing resources to generate more resources in the future, either through capital appreciation, income, or a combination of both. This can be achieved through various investment vehicles such as stocks, bonds, mutual funds, and real estate.

From an economic perspective, investment refers to the process of increasing the amount of capital available in an economy. This can include investments in physical capital such as machinery, equipment, and infrastructure, as well as investments in human capital such as education and training. Investment is a key driver of economic growth, as it allows for the expansion of production and the creation of new jobs.

From an entrepreneurial perspective, investment refers to the act of investing in a new business venture with the hope of generating profits. This can include investments in startups, small businesses, or other entrepreneurial ventures. The goal of investment from an entrepreneurial perspective is to provide the necessary capital to fund the growth and development of the venture.

From a personal perspective, investment refers to the act of allocating resources in a way that aligns with one’s personal financial goals and objectives. This can include investments in retirement accounts, college savings plans, or other long-term investment vehicles. The goal of investment from a personal perspective is to build wealth and achieve financial security over the long term.

From the above definitions, we can say that an investment can be an asset or it can be an item acquired with a goal of income generation from it or appreciation of its value. An asset may increase its value over time. That increase in value is referred to as appreciation. Most individuals purchase a good as an investment is to use it in the future to create wealth. Those things which naturally lose value over time and with use will not come under investments.

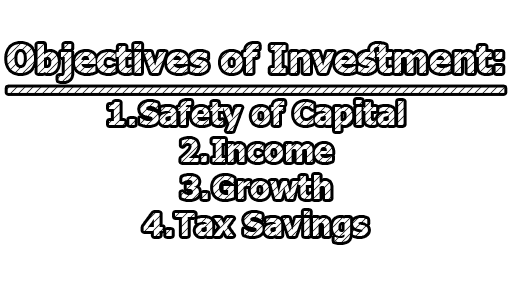

Objectives of Investment:

Investment is the act of committing resources to generate a positive return in the future. The ultimate objective of the investment is to increase wealth or financial security over the long term. To achieve this goal, investors must consider several objectives when allocating their resources. These objectives include the safety of capital, income, growth, and tax savings.

- Safety of Capital: The safety of capital is one of the primary objectives of investment. It refers to the ability of an investment to protect the investor’s initial capital against the risk of loss. No investor wants to lose their capital; therefore, the safety of capital is an essential objective of investment. The investment should have a low risk of losing value or suffering a significant decline in value.

Investors can achieve safety of capital by investing in low-risk assets such as government bonds, treasury bills, and high-quality corporate bonds. These assets provide a stable return with minimal risk. In addition, investors can diversify their portfolios by investing in different asset classes such as equities, fixed-income securities, and alternative investments. Diversification can help to reduce the risk of loss by spreading the investment across different assets with varying risk levels. It includes the following objectives:

- Government Bonds: These are low-risk investments issued by governments and have low default risk. They provide a fixed rate of return over a specific period, ensuring the safety of capital.

- Savings Accounts: Savings accounts are bank deposits that provide a fixed rate of interest and are insured by the government. These accounts have a low risk of loss, ensuring the safety of capital.

- Money Market Funds: These are mutual funds that invest in short-term, low-risk securities such as treasury bills and commercial paper. They provide a low-risk investment option and ensure the safety of capital.

- Income: Another objective of the investment is income. Investors seeking to generate a regular income stream from their investments. This income can be used to supplement their current income, meet their regular expenses, or reinvest to generate further growth.

Investors can achieve income by investing in fixed-income securities such as bonds, debentures, and preferred stocks. These securities provide a regular stream of income in the form of interest or dividends. Some investors may also invest in rental properties to generate rental income. In addition, dividend-paying stocks can provide a regular income stream for investors. It includes the following objectives:

- Dividend-Paying Stocks: These stocks pay a regular dividend to their shareholders, providing a regular stream of income.

- Corporate Bonds: These are issued by companies and provide a fixed rate of interest to the investors. They are a low-risk investment option that can provide a regular income stream.

- Real Estate Investment Trusts (REITs): These are companies that own or finance income-generating real estates properties, such as apartments, shopping malls, and office buildings. They pay a regular dividend to their investors, providing a regular income stream.

- Growth: Growth is another important objective of investment. Investors seek to generate capital appreciation over the long term. Capital appreciation refers to the increase in the value of an investment over time. Investors can achieve growth by investing in assets that have the potential to appreciate in value.

Investors can achieve growth by investing in equities or stocks of companies with strong growth potential. These companies are expected to generate high earnings and profits, which can translate into higher stock prices. Investors can also invest in alternative investments such as private equity, venture capital, or real estate, which have the potential to generate high returns over the long term. It includes the following objectives:

- Stocks of Growth Companies: These are stocks of companies that have a high potential for growth and appreciation in stock price. Examples of such companies include tech startups, biotech firms, and emerging market companies.

- Mutual Funds: These are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks and bonds. Some mutual funds focus on growth stocks and may provide higher returns over the long term.

- Real Estate: Investing in real estate properties with growth potential, such as underdeveloped land or properties in up-and-coming neighborhoods, can provide capital appreciation over the long term.

- Tax Savings: Another objective of the investment is tax savings. Investors seek to minimize their tax liability by investing in tax-efficient instruments. Tax-efficient instruments are investments that provide tax benefits or allow investors to defer tax payments.

Investors can achieve tax savings by investing in tax-efficient instruments such as retirement plans, individual retirement accounts (IRAs), and tax-free municipal bonds. These instruments provide tax benefits such as tax deductions, tax deferrals, or tax-free income. It includes the following objectives:

- Retirement Accounts: Contributions to retirement accounts such as 401(k) plans and IRAs are tax-deductible, reducing the investor’s taxable income and providing tax savings.

- Municipal Bonds: These are issued by state and local governments and provide tax-free income to investors. They can provide a tax-efficient investment option for investors in higher tax brackets.

- Exchange-Traded Funds (ETFs): These are similar to mutual funds but trade on stock exchanges like stocks. Some ETFs focus on tax-efficient investments, such as those that provide tax-free income or allow for tax deferral.

From the above discussion, we can say that investment is a crucial aspect of financial planning. Investors must consider several objectives when allocating their resources, including the safety of capital, income, growth, and tax savings. The objective of the safety of capital ensures that the investor’s initial capital is protected against the risk of loss. Income is another objective of investment that provides a regular income stream for investors. Growth is another objective that allows investors to generate capital appreciation over the long term. Tax savings is another objective that allows investors to minimize their tax liability. Investors should carefully consider their investment objectives and choose investments that align with their financial goals and risk tolerance.

Library Lecturer at Nurul Amin Degree College